Border Basin PILOT

Written by Border Basin Staff

I am the lead project developer for the Border Basin Solar project being proposed in Cass Township, Hancock County Ohio. I have led development since the beginning of the project. One aspect that is often misunderstood, both on this project and the other projects, is how or if the project will pay taxes. Let me say emphatically, yes, Border Basin will pay taxes! A lot of taxes. More taxes than I would like quite frankly. Ohio is one of the most expensive tax jurisdictions for solar projects in the country.

So how do taxes for solar projects in Ohio work and just how expensive are they?

Ohio State Law (R.C. § 5727.75) allows for renewable energy generators to be exempt from tangible personal property tax if they meet the requirements of a “Qualified Energy Project”. The range of generators that are eligible to be Qualified Energy Projects is broad and includes both solar and clean coal, to name a few. Eligible generators greater than 20 megawatts must receive approval from the county commissioners.

This tax exemption gives the appearance that Qualified Energy Projects don’t pay taxes. But there is a huge catch! The Law requires that Qualified Energy Projects make what is called a “Payment In Lieu Of Taxes”, commonly referred to by the acronym PILOT. The payment is annual and made on the same schedule as personal property tax payments. The payment goes to the County Government and is distributed the same way personal property tax payments are. I don’t know about you, but if the government is making me pay money I call it a tax. That is why I call the PILOT an Energy Tax.

The law requires that Qualified Energy Projects pay an Energy Tax equal to $7,000 per megawatt of plant capacity per year. County Commissioners can negotiate up to an additional $2,000 per megawatt per year that goes directly to the county general fund.

Border Basin applied to be a Qualified Energy Project in Summer 2021 and received unanimous approval from the Hancock County Commissioners in early fall. Hancock County Commissioners negotiated the best deal for their constituents requiring Border Basin to pay the maximum Energy Tax allowed under the law of $9,000 per megawatt. This equals $1,080,000 per year, every year for the life of the project. That is over $31,000,000 in new revenues to the county over the 30-year life of the project. Currently, the project land now generates about $35,000 in annual tax revenues for the county.

Every time taxes come up in Hancock County, I hear about the Rover Pipeline and how those developers came in and promised big dollars. I know a lot of people feel burned by the promises made and not kept. By approving our application to be a Qualified Energy Project and pay the Energy Tax, the Hancock County Commissioners ensured the same thing wouldn’t happen again. Because Rover Pipeline is taxed as regular personal property, their taxes are based on the assessed value of the pipeline. The Rover Pipeline hasn’t paid any taxes yet because they are arguing in court that their pipeline is worth less than the County assessed, and hence they should be taxed less. So instead of receiving money for local schools and services, the county is spending time and money battling the valuation. And, unfortunately, the county may face this battle every time a new assessed value is required.

What makes the Energy Tax different is that the Energy Tax is a fixed amount set by law based on the size of the project and not the project’s value or production. The only way that the Energy Tax could change is if the law changes. If Border Basin wants to build and operate, we have to pay the Energy Tax. Full Stop.

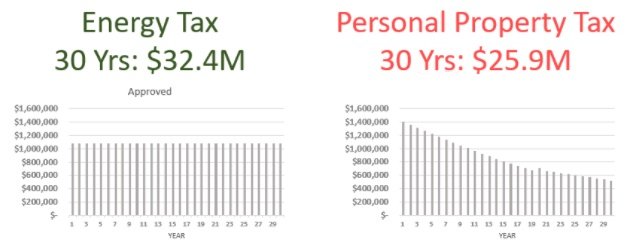

So how does the $9,000 per megawatt Energy Tax compare to the amount of money Border Basin would have paid under tangible personal property tax? Over 30 years the project will actually pay more Energy Tax then it would have paid in Personal Property Tax. The main difference is that the Energy Tax is fixed every year while the Personal Property Tax starts higher and then quickly declines as the project depreciates, which results in very low annual tax payments in the later years. Below are graphs to illustrate the differences.

Which leads to the big question - why would a for profit company ask to pay more money in taxes? Let me assure you that it is not out of the goodness of our hearts. We applied to be a Qualified Energy Project because the certainty of the fixed Energy Tax payments are preferred by lenders and investors. It is easier to get financing as a Qualified Energy Project even if we have to pay more taxes over the life of the project.